Stablecoins #

Three Types of Stablecoins #

Reserve-Based (储备型货币)

- The most common type.

- Each stablecoin is backed by an equivalent value of real-world assets.

- Examples: Tether (USDT), USD Coin (USDC).

Collateral-Based (加密资产抵押型稳定币)

- Backed by other cryptocurrencies (e.g., Ethereum, Bitcoin).

- How it works: To mint 100 stablecoins, you might need to lock up $150 worth of Ethereum as collateral. If the value of the collateral drops below a certain threshold, it’s automatically liquidated to protect the stablecoin’s value.

- Example: Dai (DAI), managed by the decentralized MakerDAO protocol.

Algorithmic (算法型稳定币)

- Not backed by any assets. Instead, algorithms are used to maintain price stability.

- How it works: The protocol increases the money supply when the price is above $1 and decreases it when the price is below $1.

- These can be extremely fragile and prone to "death spirals" during market panic.

Automated Market Makers (AMM) #

Price Curves #

Uniswap Invariant (x * y = k)

- Core Idea: Maintains a constant product

kof the quantities of two assets,xandy. - Price Curve: A hyperbola. The price is stable when the pool is balanced, but changes dramatically (high slippage) when one asset is heavily traded.

- Use Case: Suitable for any pair of volatile assets (e.g., ETH/DAI).

- Core Idea: Maintains a constant product

Stableswap Invariant (Curve)

- Core Idea: A hybrid model that behaves like

x + y = kwhen prices are close to 1:1 and transitions tox * y = kas prices diverge. - Price Curve: Nearly a straight line around the 1:1 price point, resulting in very low slippage for large trades.

- Use Case: Designed for assets with similar prices, like stablecoins (USDT/USDC/DAI) or wrapped assets (WBTC/renBTC).

- Core Idea: A hybrid model that behaves like

Liquidity Mining #

Liquidity mining is a way to incentivize users to provide liquidity to a pool.

- Rewards: Liquidity providers earn rewards from two sources:

- Trading fees

- Liquidity mining rewards (e.g., governance tokens)

- Rewards are proportional to the amount of liquidity provided.

- Liquidity can be added or removed at any time.

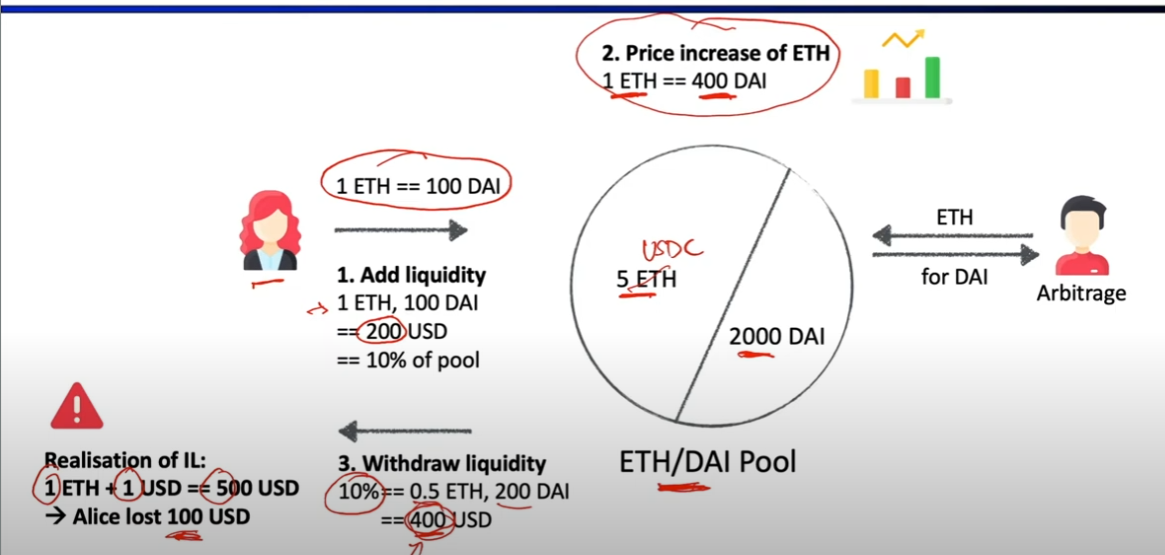

Impermanent Loss #

Impermanent Loss is the potential loss you experience by providing liquidity to a pool compared to just holding the assets (HODLing).

Arbitrage #

Arbitrage is the practice of profiting from price differences for the same asset across multiple markets. Arbitrageurs help synchronize prices.

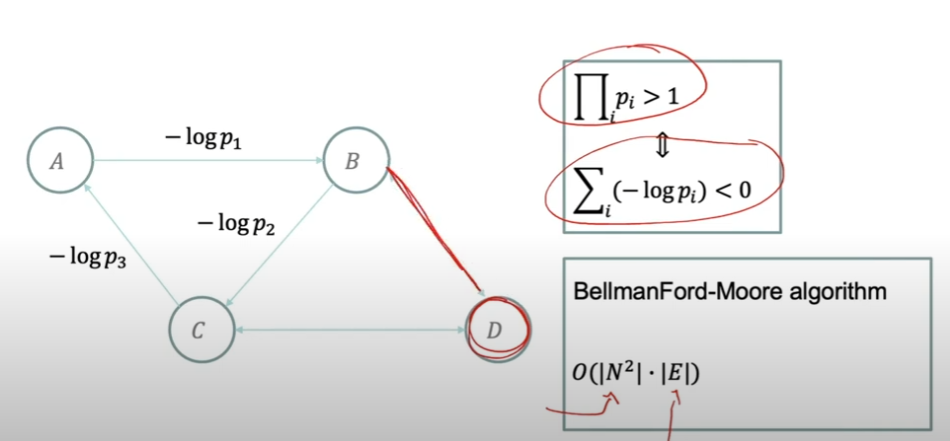

Bellman-Ford Algorithm (DeFiPoser-ARB) #

- Used for negative cycle detection to find arbitrage opportunities across multiple markets.

- Profitable Condition:

p1 * p2 * p3 > 1or(-logP1) + (-logP2) + (-logP3) < 0

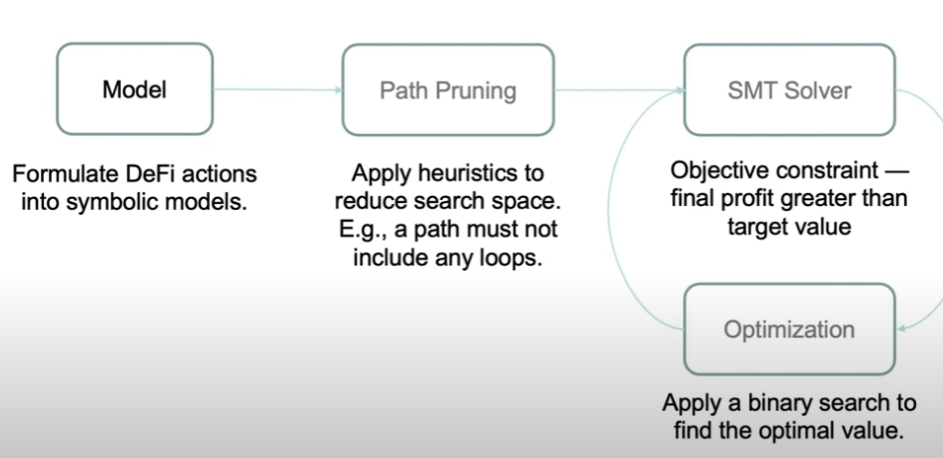

Theorem Solver (DeFiPoser-SMT) #

- Another method for finding arbitrage opportunities by encoding the DeFi model and using heuristics for path pruning.

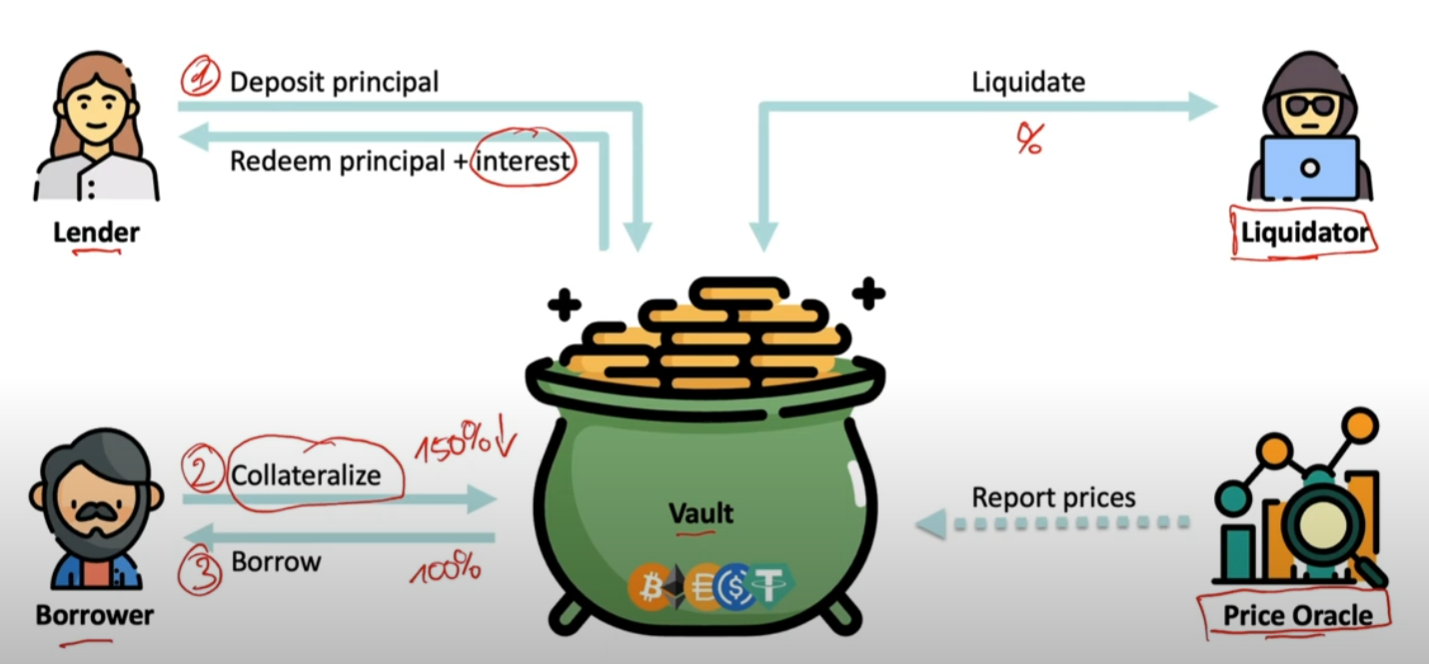

Lending and Borrowing #

- Drawbacks: On-chain lending protocols cannot use real-world information like assets, salary, or debt history.

- Leverage (Debt Multiplier): A strategy to amplify your position by repeatedly borrowing and re-hypothecating assets.

Key Terminology #

- Collateral: Assets that serve as a security deposit for a loan.

- Over-Collateralization: The value of the collateral is greater than the value of the loan. This is the standard in DeFi.

- Under-Collateralization: The value of the collateral is less than the value of the loan.

- Liquidation: If the value of the collateral falls below a certain threshold (e.g., 150% of the debt value), anyone can liquidate the debt position.

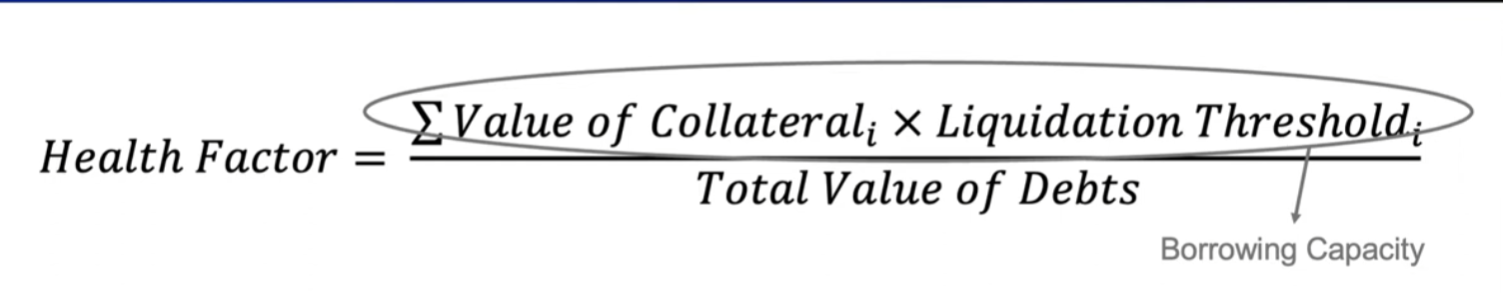

- Health Factor: A score representing the safety of your loan. A health factor below 1 is at high risk of liquidation.

- Liquidation Spread (清算价差): A bonus or discount that a liquidator receives for liquidating a position. This incentivizes liquidators to participate.

Value of Collateral to Claim = Value of Debt to Repay * (1 + Liquidation Spread)

- Close Factor: The maximum proportion of a debt that can be repaid in a single liquidation event. This protects borrowers from losing all their collateral at once.

Value of Debt to Repay < Close Factor * Total Value of Debts